german tax calculator for foreigners

This calculator supports you individually and quickly in calculating the tax for your vehicle. Employee having foreign income too more Refund of the pension insurance contributions more.

Excel Formula Income Tax Bracket Calculation Exceljet

Use our income tax calculator to calculate the tax burden resulting from your taxable income.

. From 8 99 Casio Ms20nc Colouful Desk Model In Pink Desktop Calculator Simple Calculator Calculator. Financial Facts About Germany. 2022 2021 and earlier.

It is free of charge and easy to use. National income tax rates for individuals. The date of first registration the cubic capacity and.

These figures place Germany on the 12th place in the list of European countries by average wage. Income Tax Rates Slab For Fy 2021 22 Or Ay 2022 23 Ebizfiling. The tax is only due on the capital gains above the savers lump sum of 801 euros per person.

The German Annual Income Tax Calculator for the 2020 tax year is designed to provide you with a salary payroll and wage illustration with calculations to show how much income tax you will pay in 202021 and your net pay the amount of money you take home after deductions. German Income Tax Calculator Expat Tax. There is not a wealth tax in Germany but inheritance tax varies from 7 to 50 based on the value of the inheritance.

The income tax rate for residents whose taxable income does not exceed 9408 per year is 0 between 9408 and 57051 per year 14 between 57051 and 270500 per year 42 over 270500 per year 45. A flat corporate income tax rate is 15 plus a surtax of 55 applies to the resident and non-resident companies on the profits after the deduction of business expenses. Income tax in germany for foreigners calculator.

Thus the capital gains tax including surcharges at 279951 of the profit achieved at 9 church tax or 278186 at 8 church tax. Calculate United States Sales Tax. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022.

Taxation of Foreign Companies in Germany. There is base sales tax by most of the states. The child allowance for 2019 is 7620 for a joint tax return or 3810 per parent.

This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. Real estate capital gains are only taxed if the property was not occupied by the owner and was held for under 10 years. Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download.

1 Income Tax Act are subject to income tax. The rate varies between federal states from 35 to 65 of the propertys value. 34d Income Tax Act of the German tax law determines how these are taxed Any deductions are therefore determined by the Income Tax Act Einkommensteuergesetz.

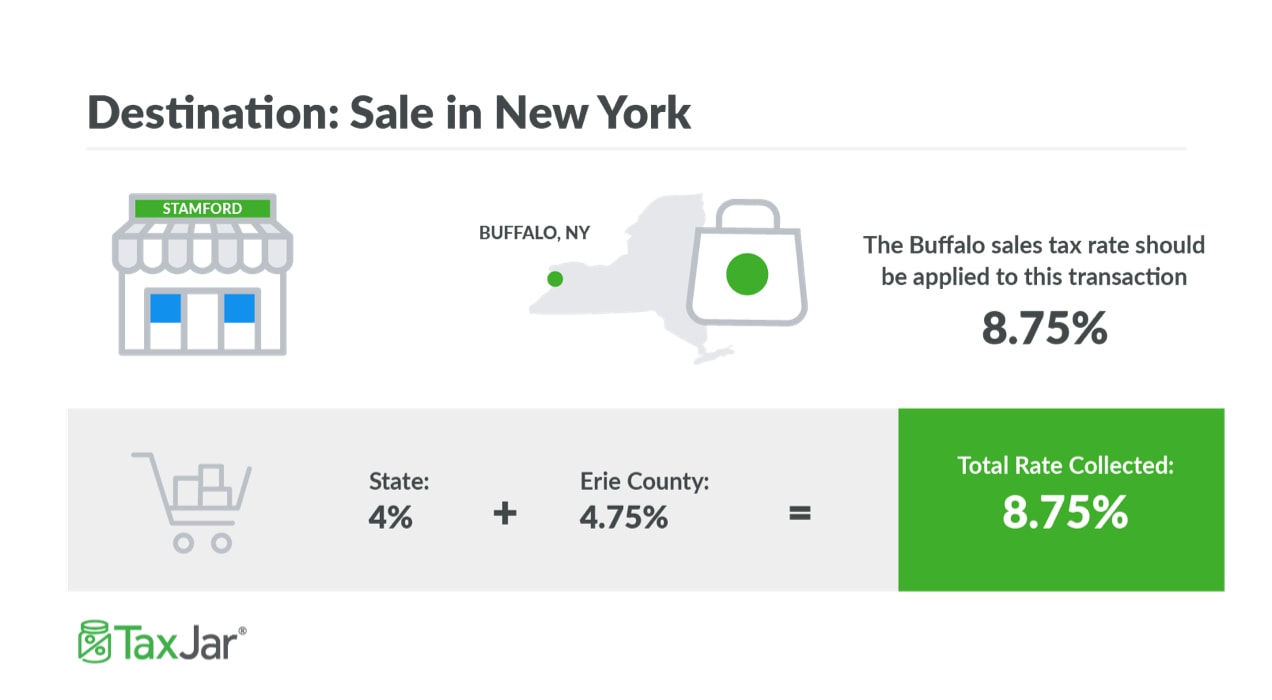

United States Sales Tax. A 55 solidarity surcharge is imposed on the income tax liability of all taxpayers. Everyone can earn foreign income from different types of income.

Calculation for December 2015. If no church tax must be paid the rate is 26375. Specify the motor type.

For 2018 it is 7428 or 3714. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. 49 69 71 67 2 67 0.

Mind you this is the income not the total volume of the capital. Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of charge. 16 19 5 7.

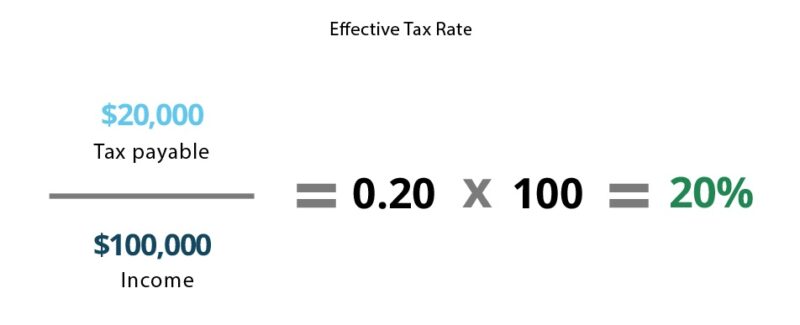

The income tax rate for a foreigner with gross salary of 40000 on the other hand is estimated to be 36 per cent. Gross Net Calculator 2022 of the German Wage Tax System. The average monthly net salary in Germany is around 2 400 EUR with a minimum income of 1 100 EUR per month.

According to 2 para. Anyone who fails to file their German income tax return on time is subject to late filing fees. Income from agriculture and forestry.

You need to fill in two fields. Tax fines in Germany. Do not fill in the currency.

The calculator will produce a full income tax calculation simply by. For each month your return is late youll be fined 025 of the total assessed tax. Is unemployment benefit.

Online Calculators for German Taxes. You can calculate corporation tax online using the German Corporation Tax Calculator. Applying for Tax Returns in Germany.

For 2018 it is 7428 or 3714. For 2017 it is 7356 or 3678. The additional solidarity surcharge is the Solidaritätszuschlag that helps finance the costs related to German unification and amounts to 55 per cent of your income tax.

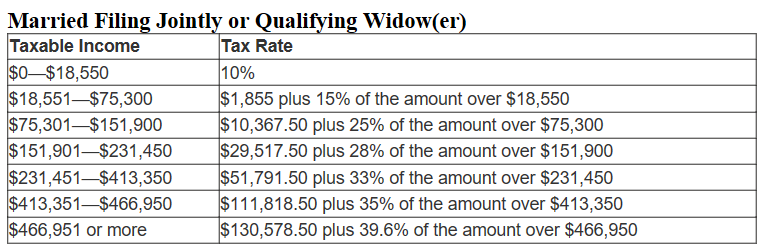

Tax Calculator in Germany. If your income falls within the second tax bracket and you earn a gross salary of 25000 you are likely to be taxed at a rate of 29 per cent. The rate of this tax is not uniform for all taxpayers but increases according to the level of income.

German Income Tax Calculator Expat Tax. If a German tax resident is a member of a church entitled to impose church tax church tax is assessed at a rate of 8 or 9 on income tax liability depending on the location. Germany is not considered expensive compared to other European countries the prices of food and housing.

Rental income taxes are due to the country where the rental is located. Dividends from shares of companies from abroad. This calculator supports you individually and quickly in calculating the tax for your vehicle.

Salary Taxes Social Security. When calculating the tax for your car for example you only have to use the. Foreign income earned during a stay in Germany is generally fully taxable.

Easily calculate various taxes payable in Germany. In addition to calculating what the net amount resulting from a gross amount is our grossnet calculator can also calculate the gross wage that would yield a. Our tax calculator is a free and easy-to-use tool which shows the amount of money your company owes in taxes in Germany.

Running an Audit in Germany. German Income Tax Calculator Expat Tax. You want to quickly calculate the probable amount of your income tax when working in Germany.

So if your tax total is 10000 youll be charged 25 a month in late fees. Foreign income that you earned during the time abroad is subject to the so-called Progressionsvorbehalt Progression proviso. Sales Tax in US varies by location.

Property sales tax Grunderwerbssteuer You will be liable to pay a property sales tax if you are buying a house in Germany. FORM A COMPANY NOW. Also known as Gross Income.

Income tax in germany for foreigners calculator. German Wage Tax Calculator 2010-2015 GrossNet and NetGross-Calculation. In addition to this the municipal trade tax is added at the rate ranging between 14 and.

This one-off tax applies when a property valued at more than 2500 euros is transferred from one owner to another. Income tax in germany for foreigners calculator.

Excel Tutorial Make A Tax Calculator In Excel How To Make A Website Ideas Of How To Make A Website Excel Tutorials Microsoft Excel Tutorial Excel Hacks

German Income Tax Calculator Expat Tax

Capital Gains Tax Calculator Ey Global

How To Calculate Foreigner S Income Tax In China China Admissions

Pta Tax Calculator For Import Of Mobile Phones In Pakistan Pta Mobile Phone Calculator

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

How To Charge Your Customers The Correct Sales Tax Rates

Income Tax Calculator For Fy 2021 22 Ay 2022 23 Free Excel Download Commerceangadi Com

Income Tax In Germany For Expat Employees Expatica

Definition Of The Statutory Tax Rate Higher Rock Education

Us Income Tax Calculator May 2022 Incomeaftertax Com

German Income Tax Calculator Expat Tax

Excel Formula Income Tax Bracket Calculation Exceljet

German Wage Tax Calculator Expat Tax

What Are Marriage Penalties And Bonuses Tax Policy Center

Marginal Tax Rate Formula Definition Investinganswers

How To Calculate Foreigner S Income Tax In China China Admissions

German Tax Calculator Easily Work Out Your Net Salary Youtube